Updated Jan. 14, 2026: Town of Florence Finance Director Carl Dudding said at a January 13 council meeting that San Tan Valley has received $2 million in HURF and $1.5 million in Vehicle License Tax for October, November, and December.

Key Points

- San Tan Valley must set local sales tax rates, adopt an interim budget, and choose a spending limit framework.

- The town currently has no property tax. Creating one would require voter approval.

- The town is receiving Vehicle License Tax and Highway User Revenue Fund distributions. State-shared sales tax will arrive soon. Income tax sharing begins July 2026.

- A presentation on sales tax is scheduled for the January 21 council meeting.

The Town of San Tan Valley took its first major step toward building a municipal budget on January 7, 2026. Finance consultant Pat Walker presented an overview of Arizona budget requirements to the Town Council. This informational session outlined how the newly incorporated town will fund services, collect revenue, and make decisions about taxes and spending limits.

No action was taken at the meeting. However, the presentation revealed key choices residents and council members will face in the coming months. These decisions include adopting an interim budget, choosing an expenditure limitation framework, setting local tax rates, and allocating funds across town services.

What Services the Town Must Fund

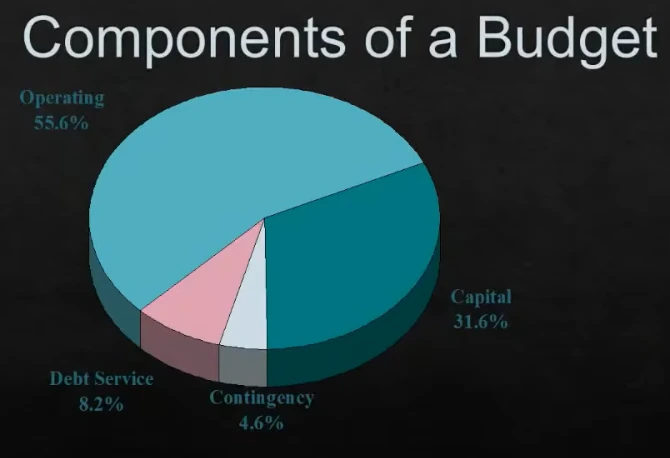

San Tan Valley’s budget will cover essential government functions. According to Walker’s presentation, a typical Arizona municipal budget breaks down into four main components. Operating expenses consume 55.6% of an average budget. Capital improvements take 31.6%. Debt service accounts for 8.2%. Contingency reserves make up the remaining 4.6%.

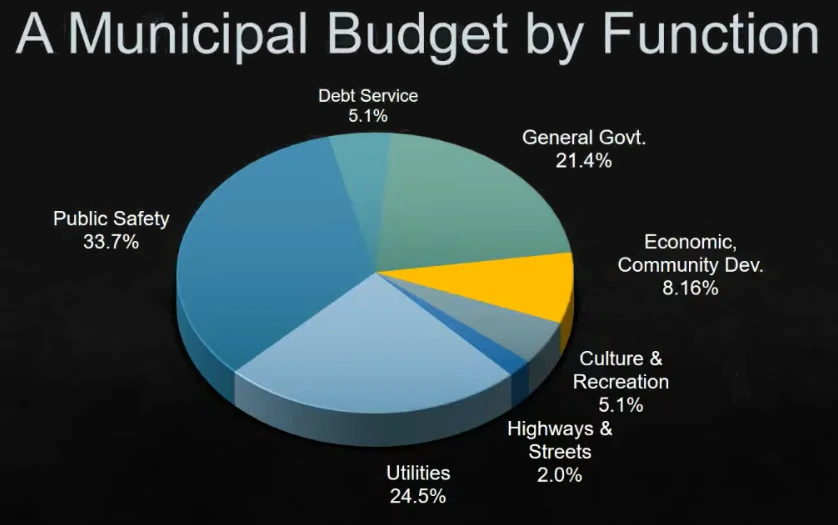

The town’s spending will fall into several functional categories. Public safety represents the largest share at 33.7% in a typical Arizona municipality. Utilities follow at 24.5%, though Walker noted this category won’t apply to San Tan Valley because it does not operate water or sewer services. General government operations account for 21.4%. Economic and community development takes 8.16%. Debt service and culture and recreation programs each account for 5.1%. Highways and streets consume 2% of average budgets.

“There’s always more needs and requests than there are resources,” Walker told the council.

Two Funds Will Drive San Tan Valley’s Finances

Walker said Arizona municipalities need at least two types of funds. The General Fund serves as the primary account for most town operations. Special Revenue Funds hold money restricted for specific purposes.

The General Fund receives revenues that can be spent on any municipal purpose. It will contain most town departments, including administration, economic development, and parks. Revenue sources for this fund include taxes, state-shared revenues, fees for service, fines and charges, interest income, and miscellaneous revenues.

Special Revenue Funds hold money that must be spent on designated purposes. For San Tan Valley, these include Highway User Revenue Fund (HURF) dollars, Pinal County Transportation Excise Tax funds (a half-cent sales tax for roads and bridges), and grants. HURF money is restricted to transportation purposes such as street maintenance, construction, and roadside development. Grant funds must follow the specific requirements attached to each award.

Walker noted that other fund types exist but don’t currently apply to San Tan Valley. Internal service funds (for services like fleet maintenance charged to departments) and capital project funds (for infrastructure and facilities) may become relevant later. Enterprise funds (for services like water, sewer, or ambulance) would apply only if the town adds such services. Fiduciary funds (for holding money in trust) are unlikely to apply.

Where the Money Will Come From

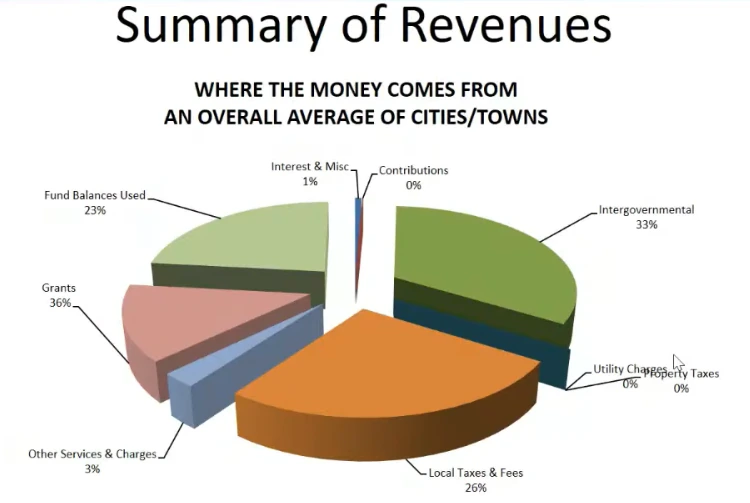

Revenue for Arizona municipalities comes from several major sources. According to Walker’s presentation, grants provide 36% of an average budget, intergovernmental revenues contribute 33%, and local taxes and fees account for 26%. These figures are illustrative averages across Arizona cities and towns, with additional categories like fund balances and interest income making up the remainder.

San Tan Valley is already receiving some state-shared revenues. The town collects Vehicle License Tax (VLT) payments and Highway User Revenue Fund distributions. State-shared sales tax will begin arriving soon. State income tax sharing will start in July 2026 because it is calculated using data from two years prior.

“Unfortunately, in Arizona, we are sales tax dependent,” Walker explained. She contrasted this with Midwestern and East Coast states that rely primarily on property taxes.

How Sales Tax Works in Arizona

Transaction Privilege Tax, commonly called sales tax, represents a critical revenue source for Arizona municipalities. This tax is levied on businesses for the privilege of conducting business in Arizona. Businesses are legally responsible for paying the tax, but they typically pass the cost along to consumers. The tax is then remitted to state and local governments.

Major sales tax categories include retail sales, hotel and motel lodging, restaurant and bar purchases, construction activity, utilities, and rentals. Walker noted that towns could have a grocery tax within the retail category. Different categories may have different rates, though restrictions apply. Walker said mining faces limitations, construction sales tax has restrictions when impact fees exist, and hotel and motel taxes have population-based constraints.

Property Tax Would Require May Election

San Tan Valley does not currently have a property tax. Creating one would require significant steps and voter approval.

Arizona divides property taxes into two types. A primary property tax can fund any municipal purpose. A secondary property tax can only pay debt service on voter-approved bonds. Since San Tan Valley has no bonds, only the primary tax option applies now.

Establishing a new primary property tax requires a public election. That election can only occur on the third Tuesday in May of any year. Walker said towns give 150 days of public notice before such elections, though some say it is not required. She said she doesn’t know of any city or town that has skipped this notice.

Walker described the most critical decision in creating a property tax. “You have to develop a maximum allowable tax base,” she said. “And that’s probably the most important thing you’ll ever do because once you develop a tax base, it’s there forever.”

After setting the initial tax base, the town can only increase it by 2% annually. New construction adds to the base separately. But the 2% annual cap on existing property cannot be exceeded.

Before pursuing a property tax, the town would need detailed information. Staff would need assessed values for all properties within town boundaries. They would need to analyze commercial, residential, and industrial property separately. Only then could they calculate how much revenue a property tax would generate.

Business Property Tax Assessments Are Declining

Property tax calculations use assessment ratios that convert market value to taxable value. Residential property uses a 10% assessment ratio. Commercial and industrial property uses a higher ratio, but that rate is declining.

According to Walker’s presentation, in fiscal year 2023 commercial and industrial property had a 17% assessment ratio. That dropped to 16.5% in fiscal year 2024. It falls to 16% in 2025 and 15.5% in 2026. By 2027 and thereafter, the commercial ratio will be 15%.

Walker warned council members to watch this trend. “That means somebody else is going to pay,” she said. The declining commercial ratio shifts more tax burden toward residential property owners when total revenue needs remain constant.

Expenditure Limitations Restrict Town Spending

Arizona’s constitution limits how much cities and towns can spend. Voters approved this restriction in 1980. The limitation uses fiscal year 1979-80 spending as a base, then adjusts for inflation and population growth.

Since San Tan Valley did not exist in 1979-80, the Economic Estimates Commission will calculate its expenditure limit. Walker said the commission is waiting for population data and will use a formula based on revenue collected per capita within the county. The presentation noted that notice of the FY27 expenditure limitation will be provided by February 1.

Walker reported that the Economic Estimates Commission said San Tan Valley does not face an expenditure limitation for its interim budget. She said this applies at least until the end of June.

Beginning in fiscal year 2027, the town will operate under the state expenditure limitation. Walker said this applies regardless of which long-term option the council pursues, since the earliest Home Rule election would be November 2026 with the limit taking effect in fiscal year 2028.

Three Options for Managing Spending Limits

San Tan Valley has three main options for handling its expenditure limitation. Each carries different implications for local control and flexibility.

Home Rule is the most flexible option, according to Walker. Under this option, voters approve an estimated budget for four years. The actual expenditure limit then becomes whatever budget the council adopts each year. Home Rule requires voter approval at a general election.

“Home rule is local control,” Walker explained. “You want to be able to spend on your citizens within your community the money you take in in your community.”

Walker cited an extreme example from another town. That community collected $21 million in revenue but could only spend $1.2 million under state expenditure limits. The difference sat unused because the town lacked an alternative limitation.

Permanent Base Adjustment adds a set amount to the state expenditure limitation. The state limitation includes exemptions, meaning grants, bonds, and interest income do not count against the spending cap. Walker said the main benefit is not needing to return to voters, though towns can seek additional adjustments if needed. She noted this option usually is not enough for growing communities.

One-Time Override is typically used when a town has lost a Home Rule election and would otherwise be under the state expenditure limitation. Walker said she hopes San Tan Valley never needs this option. “That’s not a fun thing to do,” she said.

Population Data Drives Key Calculations

Census population figures play a central role in municipal finance. The Economic Estimates Commission uses population data to calculate expenditure limitations. State-shared revenue distributions also depend on population.

San Tan Valley is working to establish its official population. The Economic Estimates Commission is waiting for this data before calculating the town’s expenditure limit. Town Manager Brent Billingsley announced earlier in the meeting that the Census Bureau sent an invoice for population certification on January 7. Pinal Post reported on this and other actions from the same meeting.

Public Notice Requirements for New Taxes

Walker noted that A.R.S. § 9-499.15 requires municipalities to provide 60 days of notice before approving any new or increased tax or fee on a business. The notice must include a schedule of the proposed charge and supporting documentation posted on the town’s website.

Franchise Fees Offer Another Revenue Option

Franchise fees provide revenue by allowing utilities to use town right-of-way for underground lines. Companies like APS or Southwest Gas pay these fees based on a percentage of their gross sales.

Franchise agreements require voter approval. They cannot exceed 25 years. After expiration, voters must approve any renewal.

This revenue source exists independently of property or sales taxes. However, it requires negotiation with utility companies and a public vote.

Budget Deadlines and Publication

Arizona law requires tentative budgets be adopted by the third Monday in July. Walker noted that towns typically complete budgets before July 1, when the fiscal year begins. Budgets must be published in newspapers for two consecutive weeks and posted on the town website within seven business days of adoption.

The Interim Budget Provides Immediate Flexibility

Because San Tan Valley incorporated after the normal budget cycle, it can adopt an interim budget. Under A.R.S. § 42-17110, newly incorporated towns can use this process to fund operations through the end of the fiscal year.

The interim budget may be adopted by ordinance. The town must hold public hearings, with Walker recommending at least two. The interim budget is not a base for computing allowable increases in the next fiscal year’s budget. The FY2027 budget may be made as if no interim budget had been adopted.

Next Council Meeting to Cover Sales Tax

The council received no votes or action items at the January 7 meeting. Finance consultant Bill Kauppi will present detailed information about Transaction Privilege Tax (sales tax) at the January 21 council meeting.

“This is an important season that’s starting, the budget season,” Walker told the council. “We thought it was very timely talking to your town attorney and your town manager that this was something that we wanted to bring forward to council sooner than later.”