The Town of Florence Council unanimously authorized staff to post a public notice of intention to raise Transaction Privilege Tax (TPT) rates on January 6, 2026. A public hearing is scheduled for March 17, 2026.

Although commonly called a sales tax, Arizona’s TPT is technically a tax on vendors for the privilege of doing business in the state. The state, county, and municipality each set their own rates. The proposed changes affect only Florence’s portion of the tax. Residents can look up their current combined tax rates using the Arizona Department of Revenue address lookup tool.

“We are not voting on the actual increase tonight,” Vice Mayor Cathy Adam said during the meeting. She noted that public budget work sessions and budget hearings will follow before any final decision. “When you hear that, you’ll start to understand the need for this money to keep our roads maintained.”

How the Proposed Florence Sales Tax Rates Would Change

The town currently collects a 2.0% TPT on most business activities. Under the proposal, most categories would rise to 3.5%. The following table shows the proposed changes:

| Business Category | Current Rate | Proposed Rate |

|---|---|---|

| Retail Sales | 2.0% | 3.5% |

| Restaurants and Bars | 2.0% | 3.5% |

| Hotels | 2.0% | 3.5% |

| Hotel/Motel Additional Tax | 2.0% | 5.0% |

| Utilities | 2.0% | 3.5% |

| Communications | 2.0% | 3.5% |

| Commercial Rental, Leasing, & Licensing for Use | 2.0% | 3.5% |

| Rental, Leasing, & Licensing for Use of TPP | 2.0% | 3.5% |

| Advertising | 2.0% | 3.5% |

| Amusements | 2.0% | 3.5% |

| Job Printing | 2.0% | 3.5% |

| Manufactured Buildings | 2.0% | 3.5% |

| Publication | 2.0% | 3.5% |

| Timbering and Other Extraction | 2.0% | 3.5% |

| Transporting | 2.0% | 3.5% |

| Marketplace and Remote Retailer Amount | 2.0% | 3.5% |

| Use Tax Purchases | 2.0% | 3.5% |

| Use Tax From Inventory | 2.0% | 3.5% |

Some rates would remain unchanged. Construction contracting stays at 4.0%. Food for home consumption remains at 2.0%. Metal mining severance also stays unchanged at 0.1%.

Proposed Revenue Uses

Town documents cite several reasons for the proposed TPT increase. Current funding sources cannot meet long-term road and infrastructure needs. Additionally, the General Fund needs strengthening to maintain essential services and offset anticipated reductions in State Shared Revenues.

Of the proposed 1.5% TPT increase, 1.0% would be deposited into a restricted special revenue fund for transportation maintenance and capital projects. The town estimates this would generate approximately $2.4 million annually for street improvement and maintenance. The remaining 0.5% would generate an estimated $1.2 million for the General Fund to help offset expected reductions in State Shared Revenues.

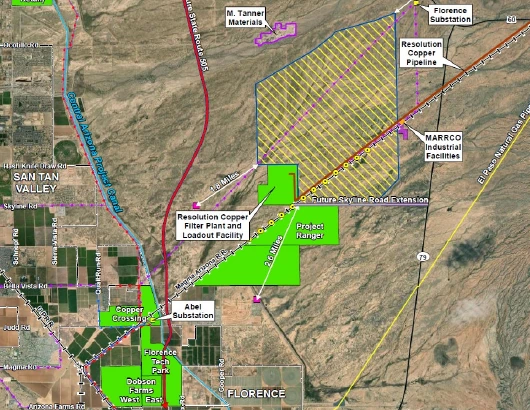

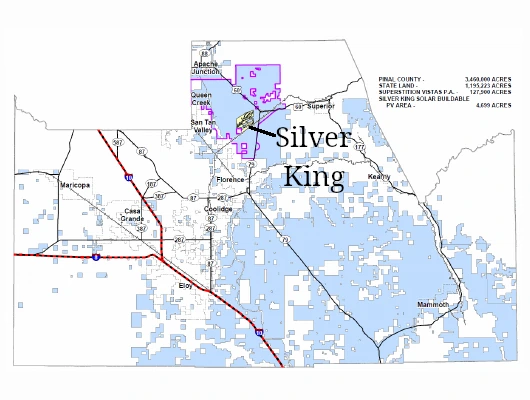

Florence is also preparing for significant growth in north Florence near the Anthem area. A third fire station is projected within three to five years. Staffing and operating that station would cost over $1 million annually once fully staffed. Police coverage would also need to expand as the service area grows.

Town documents describe the current 2.0% lodging tax as lagging behind what neighboring communities charge. The proposed 5.0% rate would bring Florence in line with the region and shift more of the burden for public safety and infrastructure onto visitors.

Council Members Express Support for Moving Forward

Mayor Keith Eaton clarified a procedural point before opening discussion. The notice must list the maximum possible rates, he explained. However, the council could ultimately approve lower amounts. They simply cannot exceed the noticed rates.

Councilmember Tony Bencina expressed support for the proposal. “I probably did a 40-hour study, printed every city and town in this state on their sales taxes and studied it,” he said. He noted that residents he spoke with were receptive. “They don’t see a problem with it, especially with the infrastructure portion of it.”

Model City Tax Code Update Notice Also Authorized

During the same meeting, the council authorized a separate notice regarding the 2012–2014 Model City Tax Code amendments. When Mayor Keith Eaton asked if this was “a housekeeping item,” Finance Director Carl Dudding confirmed.

“While researching the previous agenda item for a possible sales tax increase, we discovered that the 2012–2014 Model City Tax Code wasn’t officially adopted by the town,” Dudding explained. He noted the amendments do not change rates. Instead, they expand definitions and provide clarity.

A public hearing on this item is scheduled for February 17, 2026. The shorter notice period of 30 days applies because no rate changes are involved.

For details on how the Model City Tax Code amendments would affect Florence’s tax code, residents can review the summary and change document.

Timeline for Public Input and Decisions

Residents who want to participate in the process should note these key dates:

| Date | Event |

|---|---|

| February 17, 2026 | Public hearing on Model City Tax Code amendments |

| February 21, 2026 | Newspaper advertisement for sales tax hearing |

| March 17, 2026 | Public hearing on proposed sales tax increase |

| July 1, 2026 | Effective date if rates are approved |