Category: Pinal Unlocked

-

Law Enforcement Arguments for San Tan Valley Incorporation

Jean Stockton’s View Background and Community Awareness Current Law Enforcement Coverage Issues Public Safety and Traffic Concerns Urgency of Incorporation Decision

-

Fire Services Arguments for San Tan Valley Incorporation

Jean Stockton’s View Current Rural Metro Costs and Incorporation Benefits Democratic Control Over Fire Services Expanded Service Capabilities

-

San Tan Valley Incorporation: Law Enforcement and Services Overview

Supervisor Mike Goodman’s View Current Law Enforcement Coverage Municipal Responsibilities Upon Incorporation Additional Services and Voter Approval County’s Role in Transition Service Delivery Options and Precedents Contractual Service Arrangements Administrative […]

-

Tax and Funding Arguments for San Tan Valley Incorporation

Jean Stockton’s View County Funding Redistribution Fair Distribution of County Resources State-Level Funding Challenges Benefits of Incorporation for Political Advocacy

-

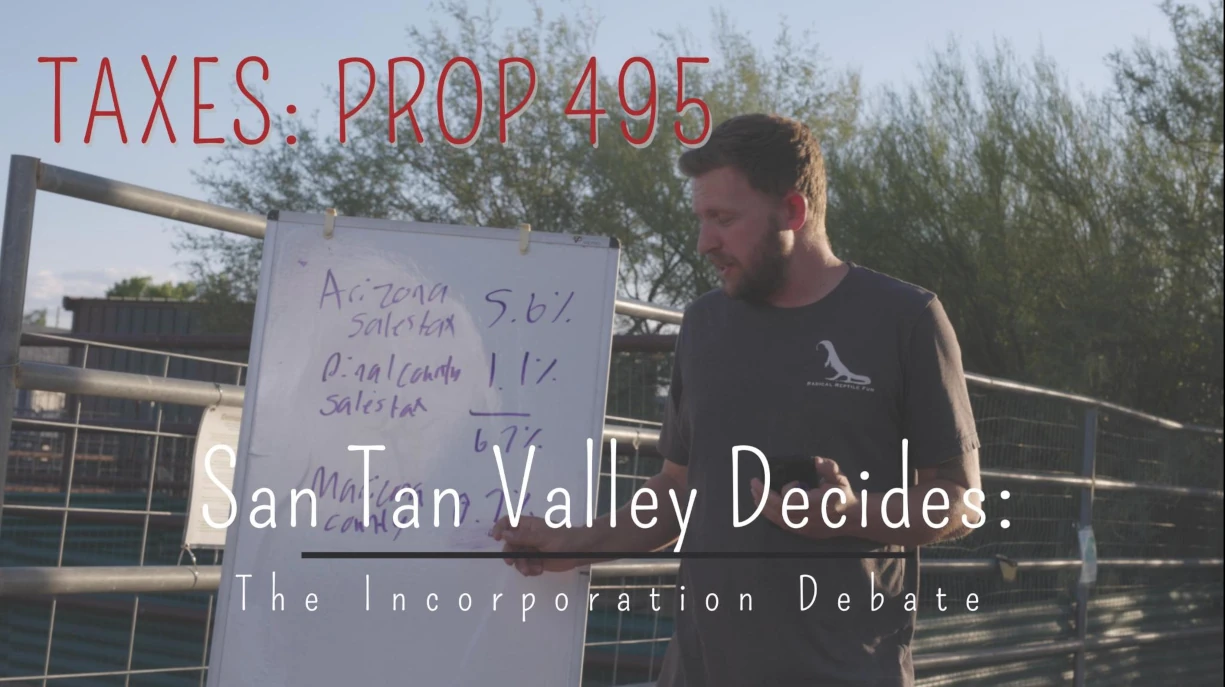

San Tan Valley’s Tax Reality: A Local Perspective

Jim Solares Tonner’s View Addressing Property Tax Misinformation Legal Requirements for City Property Tax Revenue Generation Through City Sales Tax Current Shopping Patterns and Tax Impact Limited Local Tax Increases […]

-

Supervisor Goodman: Infrastructure, Incorporation, and Tax Policy in San Tan Valley

Historical Context and Growth Challenges Property Tax: Common Concerns and Current Reality Property Tax Distribution and Usage Current Property Tax Breakdown Road and Infrastructure Investment History Municipal Revenue Advantages Sales […]

-

Representative Neal Carter: Understanding Taxes, Governance, and Community Costs

Background & Context Current Fire Coverage Situation Zoning Decision Authority Tax Implications – Sales Tax Tax Implications – Property Tax Minimum Legal Requirements for Incorporation County Tax Continuation State Shared […]

-

Keeping Tax Revenue Local: The Case for San Tan Valley Incorporation

Jean Stockton’s View Local vs. Out-of-County Shopping County Tax Retention Revenue Loss to Queen Creek Significant Tax Drain Taxation Without Representation Issues Funding Services San Tan Valley Can’t Use State […]

-

San Tan Valley Incorporation: Mike McAllister’s Tax Increase Warning

Background Political Process Concerns Current Tax Situation McAllister’s Tax Increase Prediction Business Development Counter-Argument Economic Impact Arguments McAllister’s Recommendation