At a Glance

- $7.5 million lease purchase agreement approved 4-0

- Funds intercoms, courtyard repairs, science classrooms and bathroom renovations

- Follows defeat of $48 million Proposition 498 in November 2025

- 10-year repayment term

- Estimated 4% interest rate with annual payments of roughly $922,000, pending bank bids

- Stifel Public Finance to solicit bids from 14 to 16 banks

- Funds expected by end of March 2026

CASA GRANDE, AZ – The Casa Grande Union High School District governing board on Feb. 9 unanimously approved a resolution authorizing a $7.5 million lease purchase agreement to fund facility projects. The CGUHSD lease purchase financing will address communication systems, tripping hazards, science classrooms and bathrooms.

Projects at Casa Grande Union and Vista Grande

Superintendent Jeff Lavender outlined the district’s facility needs that the funding will address.

First, the district will replace intercom and communication systems at both Casa Grande Union High School and Vista Grande High School. “We need to get an intercom system that is up-to-date, and where we can communicate with students anywhere on campus,” Lavender said.

Second, crews will repair courtyard areas at Casa Grande Union High School. Lavender said there are “a lot of tripping hazards that need immediate addressing.”

Third, the district plans to upgrade science classrooms at both schools. According to Lavender, those rooms are not up to date with the current curriculum.

Fourth, the district will renovate bathrooms at Casa Grande Union High School.

“We believe these are the four most critical projects because they deal with student safety and stuff like that,” Lavender said.

Proposition 498 Bond Defeat and Remaining Needs

These projects follow the defeat of Proposition 498, a $48 million bond measure, in November 2025. That bond would have funded $35 million in renovations, upgrades and improvements across both high schools, including HVAC, roofing, energy efficiency, security, technology and furniture. It also proposed replacing natural grass football fields with turf at both campuses and $6.5 million in district-wide facility upgrades.

Lavender told the board the district’s needs did not change with the election result. “Although we were not successful, the needs that we have, have not gone away,” he said.

How the CGUHSD Lease Purchase Financing Works

Mike LaVallee, Managing Director at Stifel Public Finance, explained the structure. Stifel, the district’s placement agent, has worked with CGUHSD since the late 1990s on elections, bond sales, refinancings and lease purchases, according to LaVallee. Jim Gill of law firm Gust Rosenfeld is serving as special counsel for this transaction.

“This is a lease, it’s not a bond backed by property tax rates,” LaVallee said.

Under the agreement, the district grants a leasehold interest on the district office facility and its grounds to the lending bank. If the district failed to make payments, the lending bank could take temporary possession of the property for the remaining term of the lease.

“If you fail to appropriate for it, which never happens in Arizona that I’m aware of, the investor, the bank could come and take the property from you for the term of the lease,” LaVallee said. “It doesn’t happen, because quite frankly, it would hurt your credit ratings and hurt your ability to borrow money in the future.”

He added the risk is time-limited. “Even if, let’s say, seven years from now, worst case, you decide not to pay, the investor would only have use of this facility for three years, for the term of the ten years, and then they have to give it back,” he said.

Board President Pro Tempore Kelly Herrington asked LaVallee to clarify. “Is it in a sense we’re kind of getting a loan and using the building as collateral?” she asked. LaVallee confirmed. “It’s a leasehold interest, yeah,” he replied.

“If we don’t pay it back, we lose the building?” Herrington asked. LaVallee said the bank could take possession of the facility, but only for the remaining term of the lease. “In all my years, I haven’t seen a failed lease purchase — not in Arizona,” he added.

Estimated Interest Rate and Yearly Payments

The lease carries a 10-year repayment term. LaVallee presented a preliminary estimate using a 4% interest rate as a placeholder. At that rate, annual payments would total roughly $922,000 in level payments.

Herrington asked why the estimated rate is lower than interest rates elsewhere. LaVallee said municipal lease purchases qualify for tax-exempt status. “Investors are accepting a lower interest rate, but they’re also not paying taxes at all, state or federal taxes, as long as they’re residents of Arizona,” he said.

The final rate will depend on competitive bids. LaVallee said his firm will send a term sheet to 14 to 16 banks that lend to Arizona municipal governments. Banks will have approximately two weeks to respond.

Repayment Sources

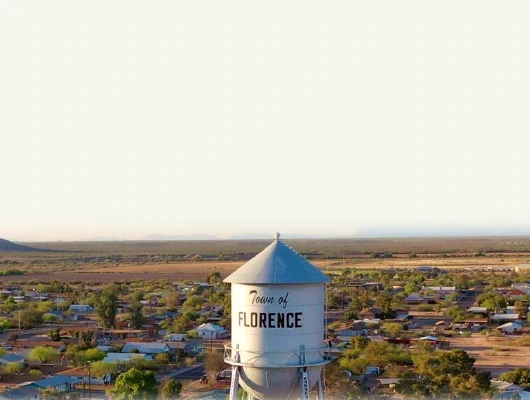

Lavender said the district receives about $3 million annually in capital funds and would use a combination of sources for repayment.

The district also retained legal impact fees from areas near Desert Sunrise High School that could total about $6 million at full build out, according to Lavender. That area was built in the CGUHSD attendance zone, but the Maricopa Unified School District is taking over those properties through a boundary change. However, the legal impact fees remained with CGUHSD. Lavender noted those fees may not arrive as quickly as the projects require.

Lavender said the lease purchase allows the district to address the projects at once within its budget.

Selecting a Lender and Prepayment Terms

The resolution delegates authority to district administration to accept bids, with Stifel assisting in determining the best one. Gill confirmed the board will not vote again on the final selection. However, he offered to share a summary of all bids with board members for informational purposes.

Board member Micah Powell asked whether prepayment penalties would apply. LaVallee said that depends on each bank’s terms.

“Sometimes we’ll get a bank bid where the interest rate is super low and it seems great, but you can’t call it in for eight years,” LaVallee said. “If you want more flexibility, you may take the second bid which is slightly higher interest rate — but maybe you can call it within a year or two.”

Board Vote and Funding Timeline

The board voted 4-0 to approve the resolution. Powell made the motion. Herrington seconded. Members Herrington, Carrie Jordan, Powell and President Steve Hayes all voted in favor.

Stifel planned to distribute the term sheet to banks by the end of the week following the Feb. 9 meeting. After the two-week bidding window, district administration will review proposals and select a lender. The bank will then conduct its own credit review before closing.

LaVallee estimated funds will be available by the end of March 2026. Lavender said he, Price and Mr. Belloc will be in contact with LaVallee and Gill as the process moves forward.